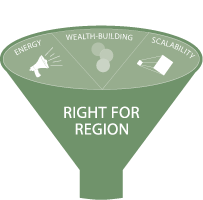

The point of building ongoing relationships with demand is to continually spot market opportunities that have good potential for your region. In WealthWorks, to narrow your selection further, it is important to consider which market opportunities are best suited for your region—meaning they will harness the most local energy, solid wealth-building potential, and capacity to scale into bigger and better results later.

Those three factors can frame how you explore your initial market opportunity options, so that you can move toward selecting one for your WealthWorks value chain. (See Module 3: Construct a WealthWorks Value Chain.)

It is important to consider which market opportunities are best suited for your region—meaning they will harness the most local energy, solid wealth-building potential, and capacity to scale into bigger and better results later.

The first factor is simple. Think about it this way: If you collected a big set of regional and community stakeholders and laid your two or three best market opportunities in the middle of a table, which one would generate the most excitement in the room? Successful economic development initiatives are frequently driven by a sense of energy, excitement, and can-do attitude. Selecting the market opportunity best suited to your region right now rightly includes finding one that springs local energy.

Why is energy important? If people are intrigued and enthusiastic about something, they are more likely to participate. Not only can that help you get started, it can keep you driving forward, especially when challenges surface. Perhaps most important, energy stimulates investment.

In WealthWorks, energy is generated by and centered around the interest of residents, businesses and organizations in a region. Interest encompasses everything an individual or business cares about—and that’s critical because interests motivate action. Interest includes but is not limited to a financial stake. WealthWorks thinks about interest in three different, but connected ways:

Sometimes the interest is already there—people care about advancing a certain sector, about the situations of certain people or places, or about emerging trends or ideas, and want to find a way to address it. Or they value something about their community and want to strengthen it. In other cases, especially when you want to explore a market opportunity for something relatively new or strange to your region, you might have to engage local stakeholders in various ways before you can gauge interests—because it may take more time for them to understand the opportunity.

Tapping into these interests is the key to building and sustaining energy around a market opportunity. But not everyone who is interested in a market opportunity has to have the same interests—one interest may motivate some, but not others, and that’s fine. For example, in producing a new biofuel in the region, some might recognize and value the common interest that it will emit less carbon into the atmosphere than other fuel options, while others might be more self-interested in its relative cost and reliable supply, and care little about the carbon factor. WealthWorks succeeds by weaving and balancing the interests of multiple partners, not by requiring partners to share or even acknowledge the same interests.

How can you gauge energy around a potential market opportunity? You often know it when you see it. In one case, you know it because people just show up for conversations or meetings. And they come back a second and a third time because they make it a priority, not because you have to push and pull them. They raise possibilities more than obstacles. They start calling you instead of you having to call them. The market opportunity starts getting mentioned in situations that you didn’t organize.

Energy is the starting point for individuals, businesses, non-profits and others to invest in your economic development activities. Individuals or groups that stand to benefit are willing to pay, invest time, sustain relationships or incur other costs to realize those benefits. See “Market opportunities: Harnessing local energy” below for one example of how different market opportunities can motivate individuals and business, based on self- or shared or common interest.

As you consider market opportunities, it can be useful to draw up a list (like the one in the table) of local parties that could be energized as a result. This is a first step in helping you assess the potential feasibility and sustainability of any market opportunity.

In Module 3, you will discover how community and economic development practitioners can leverage this energy and turn it into strategic investments that help deliver products and services to the market and build wealth in a region. For now, it is important to understand that your chosen market opportunity must tap into existing energy or galvanize new energy—based on the WealthWorks concept of interest. Selecting a market opportunity that has energy will make looking for investments much easier.

Self-interest

Energy retrofits reduce energy use—and thus energy bills—for households.

Shared interest

When electricity rates gradually increase with the cost of production, retrofits help keep utility bills affordable. This makes customers happy which means less grief for the utility companies from bill payers and regulatory agencies.

Common interest

Energy retrofits increase home values in the region, making it attractive for families to stay in or move to the area, purchase homes and send their kids to local schools.

The retrofits become a selling point for the City’s “Green Community” campaign, helping it attract funding for other green initiatives.

And, the retrofits reduce energy usage in the community, lowering carbon emissions locally and for the world.

Self-interest

Energy retrofits reduce energy bills for the school district, making it easier to balance the budget.

Shared interest

When electricity rates gradually increase with the cost of production, retrofits help keep utility bills affordable. This makes customers happy which means less grief for the utility companies from bill payers and regulatory agencies.

Common interest

Energy retrofits increase home values in the region, making it attractive for families to stay in or move to the area, purchase homes and send their kids to local schools.

The retrofits become a selling point for the City’s “Green Community” campaign, helping it attract funding for other green initiatives.

And, the retrofits reduce energy usage in the community, lowering carbon emissions locally and for the world.

Self-interest

Energy retrofits lower operating costs for individual companies since peaks in energy usage are expensive (they require bringing extra power plants online or purchasing electricity at a premium from neighboring utilities). It also allows companies to sell any excess energy production to other regions.

Shared interest

When electricity rates gradually increase with the cost of production, retrofits help keep utility bills affordable. This makes customers happy which means less grief for the utility companies from bill payers and regulatory agencies.

Common interest

Energy retrofits increase home values in the region, making it attractive for families to stay in or move to the area, purchase homes and send their kids to local schools.

The retrofits become a selling point for the City’s “Green Community” campaign, helping it attract funding for other green initiatives.

And, the retrofits reduce energy usage in the community, lowering carbon emissions locally and for the world.

Self-interest

Energy retrofits are an emerging market that offer local building contractors the potential for a new product line and new revenue.

Common interest

Energy retrofits increase home values in the region, making it attractive for families to stay in or move to the area, purchase homes and send their kids to local schools.

The retrofits become a selling point for the City’s “Green Community” campaign, helping it attract funding for other green initiatives.

And, the retrofits reduce energy usage in the community, lowering carbon emissions locally and for the world.

As noted earlier, successful economic development initiatives require an approach that is right for the market and right for the region. So far, we’ve highlighted how a good market opportunity must meet clear market demand for products and services, and how choosing one that generates local energy can spur investment in that opportunity. The question now, if you weigh several promising market opportunities, is: Which of them is likely to produce the most wealth-building results in your region?

A market opportunity has wealth-building potential, the more it:

Wealth: The eight capitals. A good market opportunity will spur investment in and mobilize activity in many (if not all) of the eight capitals. If you are going to develop a regional economic or community effort around a market opportunity, it is important to gauge how it would likely increase the quantity and strengthen the quality of those capitals, producing more benefit for the region. The more capitals it touches and the more they are increased or improved, the better the market opportunity. For example, when the Lower Rio Grande Valley selected green housing as a market opportunity, they knew it would bring greater expertise in green practices into their region of Texas (intellectual capital), create new or redesigned jobs for home builders and retrofitters (individual capital), expand investment in ailing housing stock (built capital)—and more.

Skills, understanding, physical health and mental wellness in a region’s people

Knowledge, resourcefulness, creativity and innovation in a region’s people, institutions, organizations and sector

Trust, relationships and networks in a region’s population

Traditions, customs, ways of doing, and world views in a region’s population

Natural resources—e.g., water, land, air, plants and animals—in a region’s places

Constructed infrastructure—e.g., buildings, sewer systems, broadband, roads—in a region’s places

Goodwill, influence and power that people, organizations and institutions in the region can exercise in decision-making

Monetary resources available in the region for investment in the region

Ownership and control. A good market opportunity also increases local ownership of the eight capitals in the region, as well as control or influence over decisions about their uses in the future. Ownership might come in the form of opportunities to start and own new businesses, buy land or buildings or a home, or increase individual or shared equity in them. Or it can mean owning new knowledge, like a patent, or a skill that is yours and yours alone that can carry you further in a career. Control means you can exercise influence over decisions that you could not in the past. For example, a new conservation easement might control the use of land in ways the community desires, or a new business collaborative formed around a market opportunity might exert more influence over the state legislature than each firm had managed individually.

Lasting livelihoods. Finally, a good market opportunity deploys local capital in ways that shape, improve and sustain livelihoods, with an intentional focus on ensuring that those on the economic margins both participate in the action and benefit from it. The best way to appraise this potential is to directly engage low-income people, places and firms in the process of identifying and pursuing market opportunities. For example, in Arkansas, when a regional collaborative was weighing market opportunities in the alternative energy sector, they looked at several types of alternative energy. When their choice came down to pursuing solar or biofuels, they chose the latter. Much of their decision was based on including local farmers in their discussions, and surfacing interest from a group of low-income farmers to grow a biofuel crop that would increase their income and use their fields in an underutilized, off-season growing period. The collaborative saw no such clear opportunity to increase low-income livelihoods if they pursued solar energy, so they went for the biofuel market opportunity.

As you explore various market opportunities, it is important to think through the ways in which each could advance—or detract from—these three aspects of wealth building in your region. Through the process, you can get a sense of which opportunities might build capitals you most want to focus on or will have significant positive impact on low-income people in your region. At the same time, you can also get a sense of which opportunities could be damaging to the region, whether by depleting capitals, letting benefits flow to others outside the region, or providing limited opportunities to benefit those on the economic margins. By exploring wealth-building potential, you will filter through to a market opportunity that is right for your region.

Of the many market opportunities available in your region, the ones with the most promise of building lasting wealth are those with potential for scale. Scale is important in the fields of both economic development and community development. Economic development in a region is more effective when businesses have more customers, and community development strategies are more effective when they reach more residents. Embedded in the fields of community and economic development are four dimensions of scale, all of which should be considered when selecting market opportunities.

Using scale as a screen to identify a good market opportunity is fundamentally about wanting to maximize your wealth-building results. You seek scale of demand, and production and investment specifically to improve livelihoods and upward mobility for more people, places and firms in your region—and beyond. Once you choose a market opportunity and start thinking about constructing a WealthWorks value chain around it (see Module 3), you’ll look for design options with leverage to change systems so that more can benefit from your economic and community development effort.

Specialties: Local Food, Placemaking, Renewable Energy

States served: Minnesota

Additional details: Enhancing the vitality and quality of life in Cass, Crow Wing, Morrison, Todd and Wadena counties is the mission of Region Five Development Commission. Resiliency, inclusion and collaboration are guiding concepts in achieving mutually shared goals that continue to evolve with local municipalities, state, federal, philanthropic, non-profit and social advocacy agencies.

Contact: Cheryal Lee Hills, 218-894-3233

Mailing address:

200 1st Street NE, Suite 2

Staples, MN 56479

Alternative contact: Dawn Espe, 218-894-3233

Website: http://www.regionfive.org

Specialties: Food, Forestry/wood products, Tourism

States served: Idaho, Oregon, Washington

Additional details: RDI was formed in 1991 in response to the timber industry crisis facing the Pacific Northwest. Our nationally recognized programs and services help communities help themselves with effective and results-oriented training and resources necessary for individuals living in rural communities to build and sustain a better future in their communities. Our work is based upon our genuine commitment to build rural capacity through Leadership Development programs and strengthen Rural Economic Vitality through moving capacity into action.

Contact: Amy Hause, (541) 255-9590

Mailing address:

Rural Development Initiatives

91017 S Willamette St

Coburg, Oregon 97408

Alternative contact: Heidi Khokhar, (541) 684-9077 ext. 7011

Website: http://www.rdiinc.org/

Specialties: Food, Forestry/wood products, Housing, Tourism

States served: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming

Region details: RCAC serves 13 western states including: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming. We also work in the U.S. territories of the Marianas Islands, Marshall Islands and the U.S. Virgin Islands.

Additional details: RCAC Value Chains, economic development and Wealth Works are embedded in RCAC’s Building Rural Economies program. With over 10 years of experience in these arenas we technically assist communities who wish to envision and create their future.

Contact:

Carol Cohen, 435-671-7068

Mailing address:

3120 Freeboard Drive

Suite 201

West Sacramento, CA 95691

Alternative contact: Ellen Drew, (575) 421-0261

Website: http://www.rcac.org/community-economic-development/wealthworks-west

Specialties: Energy efficiency

States served: Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, North Dakota, South Dakota, Wyoming

Additional details: Midwest Assistance Program (MAP) has been helping communities and tribal nations find solutions to their infrastructure and development needs through information, resource management, expertise, and technical assistance since 1979.

Contact: Chris Fierrros, 660-562-2575

Mailing address:

303 N Market Street, Suite 2

Maryville, MO 64468

Website: http://www.map-inc.org

Specialties: Bio-energy, Food

States served: Arkansas, Louisiana, Mississippi, Oklahoma, Tennessee, Texas

Region details: Communities Unlimited serves seven southern states: Arkansas, Mississippi, Tennessee. Texas, Oklahoma, Louisiana and Alabama. This is an area that includes 60% of this country’s persistently poor counties, including large percentages of African Americans, Hispanics, and Native Americans.

Additional details: Communities Unlimited has 40 years of community economic development experience in the South. It seeks to move rural and under-resourced places toward prosperity by identifying a community’s assets and the market demand for the products or services created from those. We then build value chain collaboratives based on WealthWorks principles to create new economic opportunities. Since 2013, we are demonstrating the success of this approach through a farm-to-fuel value chain in the Arkansas Delta.

Primary Contact:

Martha Claire Bullen, 479-443-2700

Alternative Contact:

Ines Polonius

Mailing address:

3 East Colt Square Drive

Fayetteville, AR 72703

Alternative contact: Debbie Luther, 870-509-1331

Website: https://www.communitiesu.org

Specialties: Arts, Food, Forestry/wood products, Tourism

States served: Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island, Vermont

Additional details: Community Roots, LLC is a Vermont firm specializing in rural community and economic development consulting. Melissa Levy of Community Roots, LLC has been working with the WealthWorks framework over the past several years. She’s been a trainer, coach, workshop facilitator, and presenter in the WealthWorks community.

Contact: Melissa Levy, 802-318-1720

Location: Hinesburg, VT

Specialties: Arts, Energy efficiency, Food, Forestry/wood products, Manufacturing, Tourism

States served: Kentucky, North Carolina, Ohio, Tennessee, Virginia, West Virginia

Additional details: The Central Appalachian Network is a regional network of six anchor organizations that pursue collective sustainable economic development strategies across the Appalachian region of Ohio, West Virginia, Kentucky, Virginia, and Tennessee. CAN builds regional partnerships and also works deeply at the sub-regional level around sectors and opportunities including local food value chains, forestry, new energy, small business development, social enterprise, recycling/upcycling, implementation-focused research, advocacy, and organizational capacity-building. CAN’s members are Appalachian Center for Economic Networks (ACEnet), Appalachian Sustainable Development (ASD), Coalfield Development Corporation, Community Farm Alliance (CFA), Mountain Association for Community Economic Development (MACED), Natural Capital Investment Fund (NCIF), and Rural Action.

Contact: Leslie Schaller, 740-592-3854

Mailing address:

1456 C Patton Avenue

Asheville, NC 28806

Website: https://www.cannetwork.org