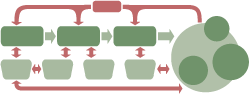

Economic and community development goals tend to drive development practice. When goals are focused primarily on creating jobs and generating income, development activities are designed to produce those results, no matter who gets income, or what kind of jobs they are. In WealthWorks, development goals are expanded to include all three elements of wealth building within a region: that is, boosting stocks of eight types of capital (while harming none), increasing the local ownership and control of that capital within the region, and improving livelihoods, including moving people, places and firms on the economic margins towards the mainstream. Working on that range of goals calls for a tool that is flexible in both its design and application—one that can broaden and deepen wealth-building impacts within a region. That tool is the WealthWorks value chain.

A WealthWorks value chain is a network of people, businesses, organizations and agencies addressing a market opportunity to meet demand for specific products or services—advancing self-interest while building rooted local and regional wealth.

A WealthWorks value chain has several defining characteristics, each of which is a critical ingredient needed to achieve wealth-building results.

Partners. WealthWorks value chains rely on a “woven” network of many actors, which WealthWorks calls “partners.” Each partner plays a role in producing and delivering products and services to the market. “Transactional” partners help develop, produce and deliver the actual product or service. Other partners play important “support” roles by providing technical assistance, finance, training or other expertise that help the transactional partners function effectively. Other support partners might smooth the way for the value chain to increase the scale of results or to loop in partners who might otherwise be left out of the action.

For example, in a WealthWorks value chain that is bringing organic tomato soup to a variety of buyers, a farmer focuses on growing flavorful tomatoes, while a food processor combines the tomatoes with other ingredients to make the best tomato soup—both are transactional partners. But an agricultural extension service, as a support partner, might help farmers learn organic practices. Or a support partner coalition of farmers, processors and buyers might lobby a state agency to lower the cost of organic certification so that more subsistence farmers can grow organic tomatoes and benefit from the higher-reward organic market.

Partners: In a health services value chain, a regional hospital and community college might partner to train local residents to meet rising demand for medical care.

Photo ©Bob Daemmrich/The Image Works

Coordinator. WealthWorks value chains are woven together by a coordinator. A WealthWorks value chain is not self-organizing and doesn’t happen by accident. The structure and quality of relationships among partners in a WealthWorks value chain are what deliver products and services to market, allow the partners to fulfill their self-interest, and help the value chain build regional wealth. So it takes the careful work of a coordinator, working with the network of partners, to intentionally design and construct a successful WealthWorks value chain. A coordinator might be an organization, a public agency, a team or a business, but coordination must be an intentional effort, and must be considered a real part of their job and responsibilities.

“Interests” as glue. WealthWorks value chains are bound together by self-interest— and strengthened by shared and common interests. Most partners in a WealthWorks value chain start working together out of selfinterest—whether that be to meet their bottom lines, advance their missions, or achieve some other goal. Relationships between core partners often begin as transactions or financial relationships. What’s unique about a WealthWorks value chain is that, over time, many of these relationships evolve and partners begin to see a shared and/or common interest in participating in the value chain.

For example, the soup processer—who has built a relationship with local farmers—might encourage the farmers to add beans and carrots to their crop rotations so that the processor can add minestrone soup to his product line. They share an interest in doing this: The soup processor expands his product line and the farmers diversify their crops and increase volume, both partners potentially boosting revenue from their activities.

Or perhaps the soup processor, farmers, and PTA all care about the health of community youth. This common interest is realized when the value chain is operating effectively and providing the school system buyers with more nutritional fare to serve in the school cafeteria.

WealthWorks thinks about interest in three different, but connected ways.

Demand-driven. WealthWorks value chains start with demand, not supply. Some economic development approaches simply assume what products and services buyers will want, and then try to push them to the market. When that assumption is incorrect, it leaves producers with unpurchased products. By identifying documented demand for products and services before you build a WealthWorks value chain, you ensure that there is a market for your goods. Buyers pull goods and services through the value chain.

Think of it this way: if you start with what producers (tomato growers) and processers can produce instead of what buyers (schools) want, you might try to sell the schools diced tomatoes for salads. But when you do that, schools tell you kids much prefer tomato soup or pizza to salad, and they will only buy small quantities of diced tomatoes. If you had built a relationship with the school first, you would have known to produce and sell soup and pizza sauce instead of diced tomatoes.

Nimble and responsive. WealthWorks value chains learn about and respond to changes in consumer preferences. WealthWorks value chain partners, because they are connected and coordinated, more easily stay on top of and communicate changing buyer preferences to others in the chain. As one partner notices price signals or changes in buyer preferences, she can alert others in the chain.

For example, the tomato grower can ask her partners in the WealthWorks value chain which tomato varieties are preferred by buyers before choosing new seeds—rather than relying on a year of poor sales to give her that information. Or the local university that is providing marketing assistance to a group of growers might share research about varieties that are trending elsewhere and likely to be in greater demand by their own buyers soon—which might trigger new conversations with buyers or investments by value chain partners.

Resourceful and inclusive. WealthWorks value chains stimulate productive investments in underutilized resources. Value chain coordinators, working with the value chain partners, look for underutilized resources within the region that, with some investment, can be woven into the value chain, increasing their productive use. Moreover, WealthWorks value chains intentionally target market opportunities that can include and directly benefit lowincome people, places and firms in the region.

In our example, the agricultural extension service might intentionally target helping local subsistence farmers learn organic practices so that they can start supplying the organic tomatoes that buyers are demanding for soup. Or network partners might uncover a local trucking firm not working at full capacity that could add a new run to pick up those farmers’ tomatoes, reducing cost for the farmers while making the trucking firm more viable.

Demand-driven and designed for scale: Knowing your demand partners, such as hotels or caterers needing laundry services, helps you meet their needs—which may then help you attract additional buyers in the future.

Photo ©Jeff Greenberg/ The Image Works

Designed for scale. WealthWorks value chains are not meant to be “one and done.” Once a value chain has successfully delivered a set of products or services to buyers, it can serve as a platform for doing more, better or different. So, from the get-go, WealthWorks value chains seek investments in partners and activities that will establish greater capacity within the region to produce at higher quantity, at a wider range of quality, or to diversify and add products and services. These are all steps towards different aspects of scale. The point of achieving scale is to maximize wealth building and the flow of benefits from it within the region.

Through the value chain, our tomato growers may be able to band together to produce enough tomatoes to satisfy the demand for soup from local schools. But if the same farmers want to supply an interested buyer from a multi-state distributor, they might need product liability insurance. That costs thousands of dollars, and no farmer could afford it alone. Thinking ahead, through intentional value chain design, these farmers could organize to secure insurance affordably through a cooperative—setting them up to establish relationships with higher-volume buyers. That’s just one example of designing for scale.

Regionally rooted. WealthWorks value chains are rooted in place. WealthWorks value chains are coordinated within a region, utilizing locally rooted resources to create a rich enabling environment that supports people, organizations, and businesses as they engage in value chain action. It’s true that a few value chain partners might be outside the region, like a state university, a financial investor, or perhaps a distant buyer of your chain’s products. But because most WealthWorks partners live, work, and play in the region, they have both self-interest and shared interest in helping more people, places and firms in the region do better.

Designed for wealth building. WealthWorks value chains are intentionally designed to achieve wealth-building ends. Clearly, there are other ways to bring players together to meet demand for products and services. And other processes can have a positive impact on a region. But often that impact is short term, or limits who it benefits. In order to build wealth that sticks and lasts in a region, WealthWorks value chains are intentionally designed to grow local stocks of capitals while harming none, strengthen local ownership and control of that capital, and improve livelihoods for those on the economic margins.

With these defining—and designing—characteristics in mind, let’s turn to an overview of the basics of building a WealthWorks value chain. Economic and community development practitioners engage in four essential activities to construct a WealthWorks value chain. The exact steps taken depend on the market opportunity selected and the partners and coordinator in any one value chain. Here we offer a broad-brush overview of the four activities.

Specialties: Local Food, Placemaking, Renewable Energy

States served: Minnesota

Additional details: Enhancing the vitality and quality of life in Cass, Crow Wing, Morrison, Todd and Wadena counties is the mission of Region Five Development Commission. Resiliency, inclusion and collaboration are guiding concepts in achieving mutually shared goals that continue to evolve with local municipalities, state, federal, philanthropic, non-profit and social advocacy agencies.

Contact: Cheryal Lee Hills, 218-894-3233

Mailing address:

200 1st Street NE, Suite 2

Staples, MN 56479

Alternative contact: Dawn Espe, 218-894-3233

Website: http://www.regionfive.org

Specialties: Food, Forestry/wood products, Tourism

States served: Idaho, Oregon, Washington

Additional details: RDI was formed in 1991 in response to the timber industry crisis facing the Pacific Northwest. Our nationally recognized programs and services help communities help themselves with effective and results-oriented training and resources necessary for individuals living in rural communities to build and sustain a better future in their communities. Our work is based upon our genuine commitment to build rural capacity through Leadership Development programs and strengthen Rural Economic Vitality through moving capacity into action.

Contact: Amy Hause, (541) 255-9590

Mailing address:

Rural Development Initiatives

91017 S Willamette St

Coburg, Oregon 97408

Alternative contact: Heidi Khokhar, (541) 684-9077 ext. 7011

Website: http://www.rdiinc.org/

Specialties: Food, Forestry/wood products, Housing, Tourism

States served: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming

Region details: RCAC serves 13 western states including: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming. We also work in the U.S. territories of the Marianas Islands, Marshall Islands and the U.S. Virgin Islands.

Additional details: RCAC Value Chains, economic development and Wealth Works are embedded in RCAC’s Building Rural Economies program. With over 10 years of experience in these arenas we technically assist communities who wish to envision and create their future.

Contact:

Carol Cohen, 435-671-7068

Mailing address:

3120 Freeboard Drive

Suite 201

West Sacramento, CA 95691

Alternative contact: Ellen Drew, (575) 421-0261

Website: http://www.rcac.org/community-economic-development/wealthworks-west

Specialties: Energy efficiency

States served: Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, North Dakota, South Dakota, Wyoming

Additional details: Midwest Assistance Program (MAP) has been helping communities and tribal nations find solutions to their infrastructure and development needs through information, resource management, expertise, and technical assistance since 1979.

Contact: Chris Fierrros, 660-562-2575

Mailing address:

303 N Market Street, Suite 2

Maryville, MO 64468

Website: http://www.map-inc.org

Specialties: Bio-energy, Food

States served: Arkansas, Louisiana, Mississippi, Oklahoma, Tennessee, Texas

Region details: Communities Unlimited serves seven southern states: Arkansas, Mississippi, Tennessee. Texas, Oklahoma, Louisiana and Alabama. This is an area that includes 60% of this country’s persistently poor counties, including large percentages of African Americans, Hispanics, and Native Americans.

Additional details: Communities Unlimited has 40 years of community economic development experience in the South. It seeks to move rural and under-resourced places toward prosperity by identifying a community’s assets and the market demand for the products or services created from those. We then build value chain collaboratives based on WealthWorks principles to create new economic opportunities. Since 2013, we are demonstrating the success of this approach through a farm-to-fuel value chain in the Arkansas Delta.

Primary Contact:

Martha Claire Bullen, 479-443-2700

Alternative Contact:

Ines Polonius

Mailing address:

3 East Colt Square Drive

Fayetteville, AR 72703

Alternative contact: Debbie Luther, 870-509-1331

Website: https://www.communitiesu.org

Specialties: Arts, Food, Forestry/wood products, Tourism

States served: Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island, Vermont

Additional details: Community Roots, LLC is a Vermont firm specializing in rural community and economic development consulting. Melissa Levy of Community Roots, LLC has been working with the WealthWorks framework over the past several years. She’s been a trainer, coach, workshop facilitator, and presenter in the WealthWorks community.

Contact: Melissa Levy, 802-318-1720

Location: Hinesburg, VT

Specialties: Arts, Energy efficiency, Food, Forestry/wood products, Manufacturing, Tourism

States served: Kentucky, North Carolina, Ohio, Tennessee, Virginia, West Virginia

Additional details: The Central Appalachian Network is a regional network of six anchor organizations that pursue collective sustainable economic development strategies across the Appalachian region of Ohio, West Virginia, Kentucky, Virginia, and Tennessee. CAN builds regional partnerships and also works deeply at the sub-regional level around sectors and opportunities including local food value chains, forestry, new energy, small business development, social enterprise, recycling/upcycling, implementation-focused research, advocacy, and organizational capacity-building. CAN’s members are Appalachian Center for Economic Networks (ACEnet), Appalachian Sustainable Development (ASD), Coalfield Development Corporation, Community Farm Alliance (CFA), Mountain Association for Community Economic Development (MACED), Natural Capital Investment Fund (NCIF), and Rural Action.

Contact: Leslie Schaller, 740-592-3854

Mailing address:

1456 C Patton Avenue

Asheville, NC 28806

Website: https://www.cannetwork.org