To build a region’s wealth, WealthWorks considers not just financial assets, but includes the stock of all capitals in a region. This approach takes into account all the features of a city, town, countryside or region that make it a good place to live, work and visit. These might include:

Each of these represents a component of a type of capital. Some components of capital—like the ones listed above—are more immediately recognizable than others. Some are less visible because they are in disrepair, not used, or taken for granted. Such “underutilized resources,” if identified and invested in, could contribute more to the region’s wealth. For example, a vacant lot considered an eyesore today could, with imagination and investment, become a productive community garden or recreational space tomorrow. Under skilled but willing workers could, with investment in training programs for skills that local firms need, become the region’s strongest asset.

The eight capitals: intellectual, financial, natural, cultural, built, political, individual and social.

The existing stock of skills, understanding, physical health and mental wellness in a region’s people.

The existing stock of knowledge, resourcefulness, creativity and innovation in a region’s people, institutions, organizations and sectors.

The existing stock of trust, relationships and networks in a region’s population.

The existing stock of traditions, customs, ways of doing, and world views in a region’s population.

The existing stock of natural resources—for example, water, land, air, plants and animals—in a region’s places.

The existing stock of constructed infrastructure—for example, buildings, sewer systems, broadband, roads—in a region’s places.

The existing stock of goodwill, influence and power that people, organizations and institutions in the region can exercise in decision-making.

The existing stock of monetary resources available in the region for investment in the region.

In WealthWorks, to get started, you must first get a handle on the eight capitals. As the concept of wealth-building becomes more familiar, you will see how qualities of a community or region can be captured within the eight capitals. For example, having a college or university with a specialized technology center that relates to an important local industry ramps up your region’s intellectual capital. Well-publicized and understood government processes that invite resident participation contribute to a region’s political capital. High levels of volunteerism can be counted as part of your region’s social capital. Readily accessible and affordable excellent early childhood programs for low-income residents can build individual capital in your region’s future workers and entrepreneurs.

Wealth is the collection—or stock—of all eight capitals a region has available at a given point in time. Every time economic and community developers make decisions in their work, they likely help grow or deplete the stock of one or more of these capitals. That’s why WealthWorks is designed to help economic and community developers think about wealth in terms of all these capitals—and how they interact. Each capital can be invested in and grown—or depleted—in ways that increase or decrease both a region’s current wealth and its future prospects.

It can help to picture the stock of any one of these eight capitals in your community as the water in a bathtub—and then to think about anything that might happen to change the level or qualities of that stock of water. To build that stock of water, you must pay attention to five things:

Quantity of stock. This is simple. How much water do you have right now that you might use for some purpose?

Quality of stock. But what is that water like? Is it dirty, clean, hot, cold, hard or soft? Stocks of capital that are not in good shape, or that are not in the shape needed to use them for development, can create lots of problems and even undermine other forms of capital. For example, even if you have a lot of water in your tub, if it’s polluted, it has limited use for development and can even deplete components of other capitals—like human health. In short, a stock of capital that lacks needed quality likely cannot contribute to wealth building without more investment.

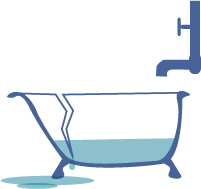

And sometimes water flows out not because you redirected it, but because there is a crack in the tub that has sprung a leak. This kind of flow out of your tub is depleting your stock of capital. In this case, to preserve your stock of water and stop it from draining, you first have to realize there is a leak, then find it, then discover what is causing it, and then figure out how to fix it. One way to think of this is as waste. If you regularly use a gallon of water to make something happen, and you discover that a half-gallon would do, you have found a crack you can fix to preserve your stock of water.

No flow: Stagnation. If you fill a tub with water and just let it sit there, what happens? Over time, the water level goes down as it evaporates. It may even change quality, get cold or hot, or start to grow scum on the surface that you simply don’t want. Just like that water, the stock of any underutilized capital, left alone and untended, will tend to evaporate—or depreciate—over time.

To increase the stock of any capital—that is, to increase its wealth-building potential—it makes sense to pay attention to all these things. If you consume too much and forget to reinvest, the bathtub runs dry. If you consume too little, the water may stagnate and lose value. If you allow flows into the tub that pollute the water, your stock of water depreciates and has fewer productive uses.

But if you thoughtfully use a portion of your stock to “water” or invest in other types of capital, you can create a win-win situation that produces multiple benefit flows. These flows then raise the reservoir stock of other capitals so that they are available for current and future generations. Controlling the water that enters from the tap and exits through the drain or leaks from any cracks—all while maintaining the quality of water that’s in the tub—illustrates one critical practice of regional wealth-building. It is the key to building resiliency.

By using the WealthWorks framework, economic and community development practitioners can better identify, assess and deploy their existing wealth—their eight capitals—over time. And they can gauge how their development efforts help the useful stocks of each capital either grow or diminish in the region.

Investing to train local workers for existing jobs not only builds skills but leads to better jobs, larger incomes, and greater stability for families.

Photo ©Maximilian Stock Ltd/Science Faction/Corbis

For example, when you invest in training that builds the skills of local workers to match existing local jobs, you expect workers to gain improved skills and a better job, along with a larger income, more stability for their families, and the ability to invest in their children’s educations down the line. When communities invest in restoring farmland or clam flats, they expect more productive farms and flats as well as greater incomes for farmers or shell-fishers, more regional job security, more stable families and resilient communities—now and in the future. In both cases, identifying and making the most of an existing stock of capital—while recognizing its relation to other types of capital—is a necessary step toward regional wealth-building.

A few simple guidelines, if regularly considered and practiced, can help economic and community development practitioners work with and across the capitals for better wealth-building results:

Know your inventory. The starting point in any development effort is knowing what you have available to work with right now. Scanning where your region stands in relation to your stocks of all eight capitals—in effect, an inventory of their quality, quantity and flows—will surface a fuller set of opportunities to consider and may help you realize you have more tools at hand than you thought.

Look for underutilized resources. Taking such an inventory can also help you identify resources that are lying idle or depreciating due to stagnation. These underutilized resources might be put to more productive use—and present ripe opportunities for investment and wealth building. For example, you might uncover a cohort of hard-working young people in minimum-wage jobs who are looking for better jobs elsewhere. They might offer an investment opportunity—if you can help them acquire the skills needed for work in an emerging short-staffed sector in your region.

Communities that offer scholarships for youth to attend far-away universities are building individual capital, but if the youth don’t return to the region, that wealth doesn’t “stick.”

Photo courtesy US Department of Education

When you systematically strike a good balance for all eight capitals, it not only increases the healthy stock of each capital, it leads to a more sustainable economy that both meets current needs and offers more potential to build wealth in the future.

Specialties: Local Food, Placemaking, Renewable Energy

States served: Minnesota

Additional details: Enhancing the vitality and quality of life in Cass, Crow Wing, Morrison, Todd and Wadena counties is the mission of Region Five Development Commission. Resiliency, inclusion and collaboration are guiding concepts in achieving mutually shared goals that continue to evolve with local municipalities, state, federal, philanthropic, non-profit and social advocacy agencies.

Contact: Cheryal Lee Hills, 218-894-3233

Mailing address:

200 1st Street NE, Suite 2

Staples, MN 56479

Alternative contact: Dawn Espe, 218-894-3233

Website: http://www.regionfive.org

Specialties: Food, Forestry/wood products, Tourism

States served: Idaho, Oregon, Washington

Additional details: RDI was formed in 1991 in response to the timber industry crisis facing the Pacific Northwest. Our nationally recognized programs and services help communities help themselves with effective and results-oriented training and resources necessary for individuals living in rural communities to build and sustain a better future in their communities. Our work is based upon our genuine commitment to build rural capacity through Leadership Development programs and strengthen Rural Economic Vitality through moving capacity into action.

Contact: Amy Hause, (541) 255-9590

Mailing address:

Rural Development Initiatives

91017 S Willamette St

Coburg, Oregon 97408

Alternative contact: Heidi Khokhar, (541) 684-9077 ext. 7011

Website: http://www.rdiinc.org/

Specialties: Food, Forestry/wood products, Housing, Tourism

States served: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming

Region details: RCAC serves 13 western states including: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming. We also work in the U.S. territories of the Marianas Islands, Marshall Islands and the U.S. Virgin Islands.

Additional details: RCAC Value Chains, economic development and Wealth Works are embedded in RCAC’s Building Rural Economies program. With over 10 years of experience in these arenas we technically assist communities who wish to envision and create their future.

Contact:

Carol Cohen, 435-671-7068

Mailing address:

3120 Freeboard Drive

Suite 201

West Sacramento, CA 95691

Alternative contact: Ellen Drew, (575) 421-0261

Website: http://www.rcac.org/community-economic-development/wealthworks-west

Specialties: Energy efficiency

States served: Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, North Dakota, South Dakota, Wyoming

Additional details: Midwest Assistance Program (MAP) has been helping communities and tribal nations find solutions to their infrastructure and development needs through information, resource management, expertise, and technical assistance since 1979.

Contact: Chris Fierrros, 660-562-2575

Mailing address:

303 N Market Street, Suite 2

Maryville, MO 64468

Website: http://www.map-inc.org

Specialties: Bio-energy, Food

States served: Arkansas, Louisiana, Mississippi, Oklahoma, Tennessee, Texas

Region details: Communities Unlimited serves seven southern states: Arkansas, Mississippi, Tennessee. Texas, Oklahoma, Louisiana and Alabama. This is an area that includes 60% of this country’s persistently poor counties, including large percentages of African Americans, Hispanics, and Native Americans.

Additional details: Communities Unlimited has 40 years of community economic development experience in the South. It seeks to move rural and under-resourced places toward prosperity by identifying a community’s assets and the market demand for the products or services created from those. We then build value chain collaboratives based on WealthWorks principles to create new economic opportunities. Since 2013, we are demonstrating the success of this approach through a farm-to-fuel value chain in the Arkansas Delta.

Primary Contact:

Martha Claire Bullen, 479-443-2700

Alternative Contact:

Ines Polonius

Mailing address:

3 East Colt Square Drive

Fayetteville, AR 72703

Alternative contact: Debbie Luther, 870-509-1331

Website: https://www.communitiesu.org

Specialties: Arts, Food, Forestry/wood products, Tourism

States served: Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island, Vermont

Additional details: Community Roots, LLC is a Vermont firm specializing in rural community and economic development consulting. Melissa Levy of Community Roots, LLC has been working with the WealthWorks framework over the past several years. She’s been a trainer, coach, workshop facilitator, and presenter in the WealthWorks community.

Contact: Melissa Levy, 802-318-1720

Location: Hinesburg, VT

Specialties: Arts, Energy efficiency, Food, Forestry/wood products, Manufacturing, Tourism

States served: Kentucky, North Carolina, Ohio, Tennessee, Virginia, West Virginia

Additional details: The Central Appalachian Network is a regional network of six anchor organizations that pursue collective sustainable economic development strategies across the Appalachian region of Ohio, West Virginia, Kentucky, Virginia, and Tennessee. CAN builds regional partnerships and also works deeply at the sub-regional level around sectors and opportunities including local food value chains, forestry, new energy, small business development, social enterprise, recycling/upcycling, implementation-focused research, advocacy, and organizational capacity-building. CAN’s members are Appalachian Center for Economic Networks (ACEnet), Appalachian Sustainable Development (ASD), Coalfield Development Corporation, Community Farm Alliance (CFA), Mountain Association for Community Economic Development (MACED), Natural Capital Investment Fund (NCIF), and Rural Action.

Contact: Leslie Schaller, 740-592-3854

Mailing address:

1456 C Patton Avenue

Asheville, NC 28806

Website: https://www.cannetwork.org